Bitcoin, Japan and a Tin Miner

Manage episode 439318672 series 3586928

Don’t forget Shaping The Earth, “my lecture with funny bits” in London this October 9th and 10th at the Museum of Comedy. Please come if you fancy a bit of “learning and laughter”.

Three subjects I want to briefly look at today, starting with everyone’s favourite non-government money.

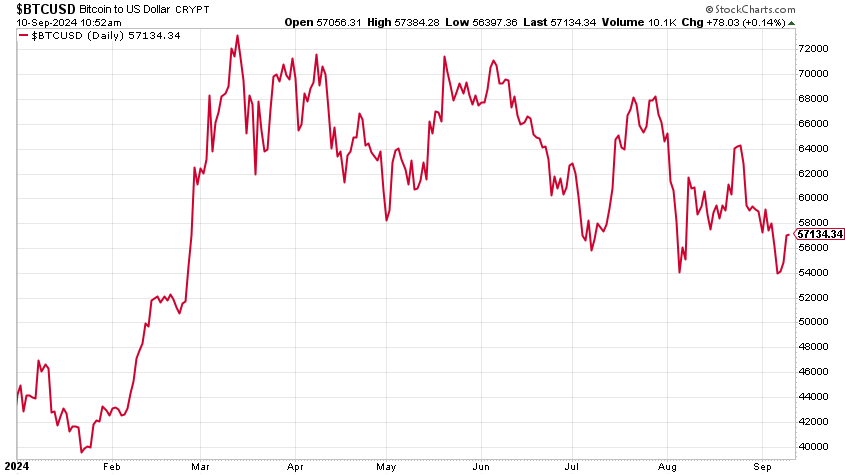

There were rich promises of huge gains in bitcoin with the launch of the bitcoin ETFs and the halving cycle. Neither has quite materialised.

Bitcoin is “only” up by 30% this year, though to read some of the commentary, you’d think this is another Bitcoin winter.

The problem is that most of those gains came in February. For the other eight months of 2024, we’ve been generally stagnant. In fact, since March, we’ve been making a series of lower lows and lower highs and are clearly in a downtrend—hence the despondency.

However, despondency is often the ally of the contrarian investor, and with that in mind, I want to share a table with you (borrowed from Coinglass).

It shows Bitcoin’s quarterly performance. I’m sharing this now because we’re heading into Q4, which has historically been Bitcoin’s best quarter, with average returns close to 90%.

Seasonal patterns aren’t always the most reliable indicator, but the odds are favourable: seven positive Q4s against just four negative ones.

Better than Q1, which is 50:50; Q2 with seven positive and five negative; and Q3, which shows five positive and seven negative years (including this one, which isn’t over yet).

Let’s hope those averages hold.

I argue that Bitcoin should be a core holding. Many don’t like bitcoin, but the potential is so huge that, in my view, the greater risk is not owning it rather than owning it.

My guide to buying Bitcoin is here. And here, I detail the easiest way for UK investors to gain exposure via a traditional broker.

How Japan finances the world - and why we should be worried

About a month ago we explained the summer turmoil and the unwinding of the yen carry trade. The big question we all want to know the answer to is: was that it? Are we done now, or is there more to come?

19 つのエピソード